At a Thinkbox event in London on Tuesday, the TV marketing body’s head of research argued that measuring adspend from the long tail of advertisers has skewed analysts’ ability to accurately measure growth in the ad industry and value traditional media channels.

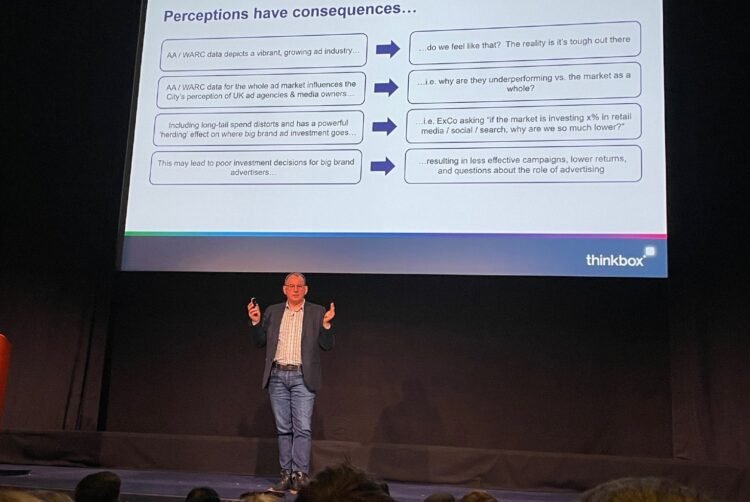

“The AA/Warc data is presenting a picture of a vibrant, growing advertising industry,” said Anthony Jones. “Do we feel like that?”

The latest Expenditure Report found that total adspend in the UK rose 9.7% in Q3 2024 to £10.6bn, driven primarily by double-digit growth in search and online display. Total ad revenue for TV, meanwhile, fell 2.6% year on year.

But Jones argued that the strong market-level growth figures were being substantially skewed by small and medium-sized enterprises (SMEs) spending on search and social media placements that are “not real advertising investment as we would historically view it”.

Jones noted that before the Covid-19 pandemic, “one of the immutable laws of advertising investment” was that it was highly correlated with GDP growth (typically 1.0-1.5% of GDP). This changed beginning in 2020, when ad industry growth began running as a much higher share of GDP, driven almost entirely by “the pointy end of the funnel” — search, social and other pure-play digital spend — which has more than doubled ad revenue in the past five years.

“It’s almost like a cost to sale,” Jones said, citing the opinion of industry analyst Ian Whittaker. “For the online small brands, instead of buying rent, they’re buying search space to drive consumers to the store.”

Jones compared spend on digital pure-play channels — including retail media — to “digital shelf wobblers”, telling the audience at Ham Yard Hotel: “You might’ve spent money with a retailer in the past buying the gondola ends. You’re now investing in search and retail media. It is an essential spend, not a discretionary spend.”…

Read The Full Article at The Media Leader